By taxing emissions, it incentivizes businesses to update their operations so they reduce their contribution to global warming.

A carbon tax requires 3 key elements:

Pricing – governments must set a price on greenhouse gas emissions.

Monitoring – we need a reliable way to measure the amount of emissions released by companies.

Enforcement – taxes, fines, and other methods for enforcing the carbon tax must be put in place to keep companies honest.

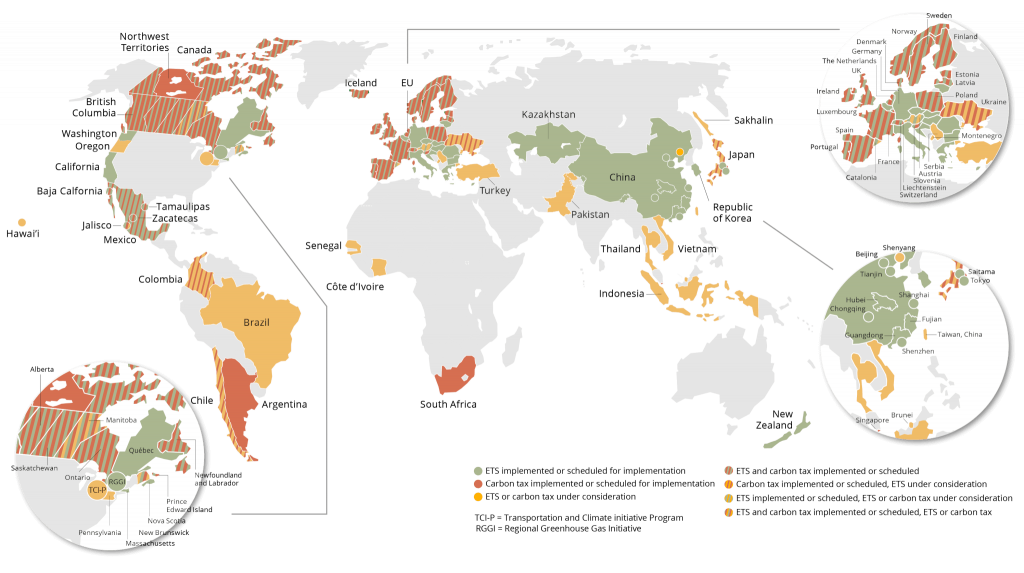

Some countries have already implemented carbon taxes.